According to our experts, the Efforts of the FM to restore economic growth while enlightening a clear roadmap in healthcare, infrastructure, and insurance is bound to bring confidence to the industry.

A big thanks to all our partners and our knowledge management team who put in their efforts and aided in making Budget 2021 a success. Once again, thank you all for your support and efforts. Indeed, our efforts have been also appreciated by the media fraternity.

Likewise, last year Nangia Andersen had a collaboration with Financial Express wherein our partners’ have shared their bits of knowledge on the budget proposals while FM was delivering the speech.

Here are some highlights of Budget 2021- Nangia Andersen(Expert’s Take) Media Coverage:

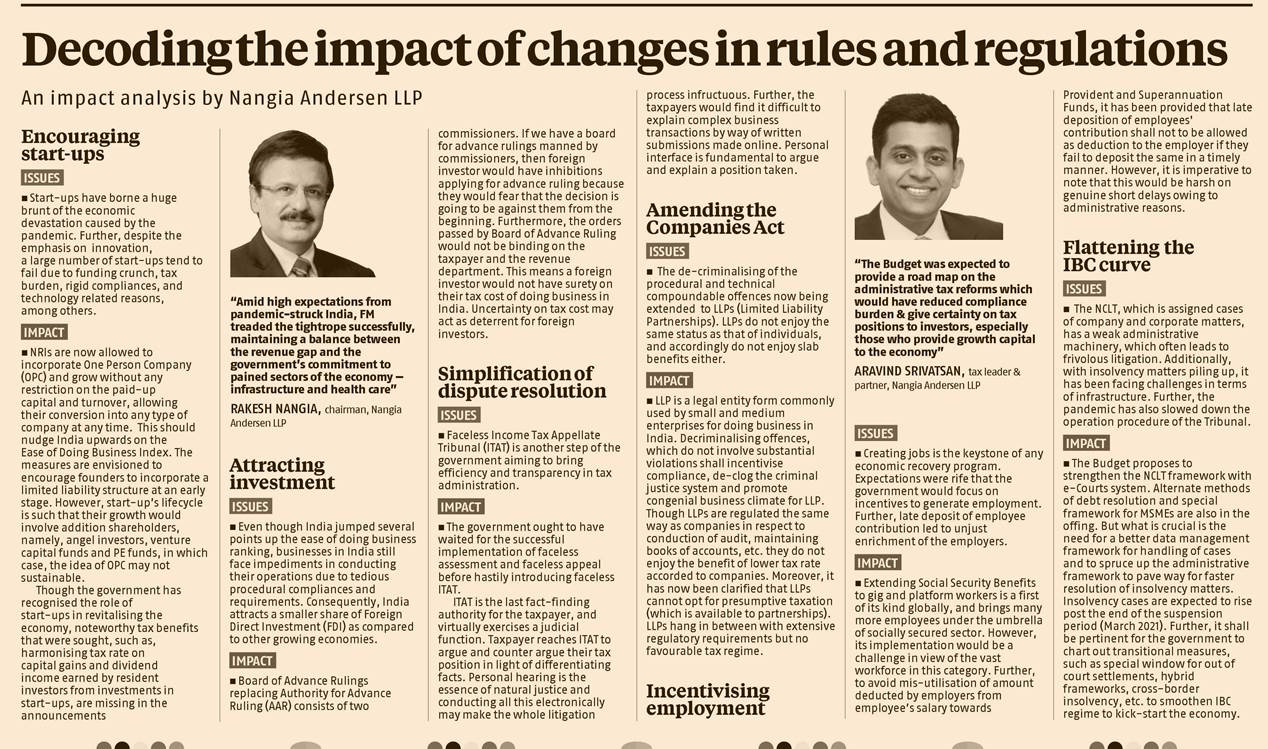

Mr Nangia and Aravind Srivatsan decode the changes in Budget 2020 for Business Standard(Half page article)

Mr Nangia shares his take on Budget 2021 with Zee Business

Mr Nangia and Aravind Srivatsan decode the Budget 2020 for Financial Express

Vishwas shares his take on Budget 2021 in an live conversation with News18

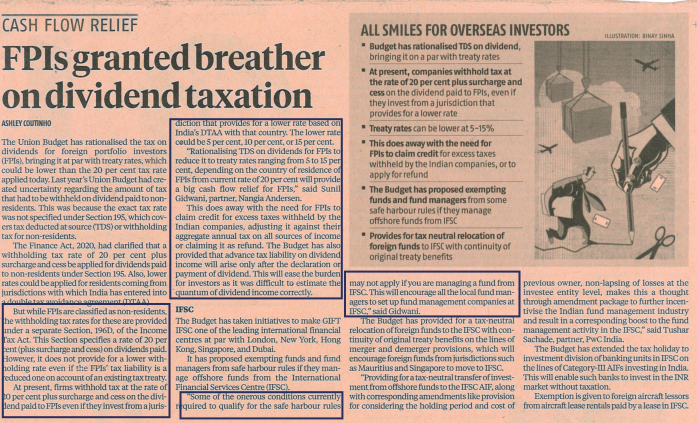

Sunil Gidwani decodes the impact on Financial Sector for Business Standard.

Nischal Arora shares insights on Divestment and pvt. Policy for Business Standard

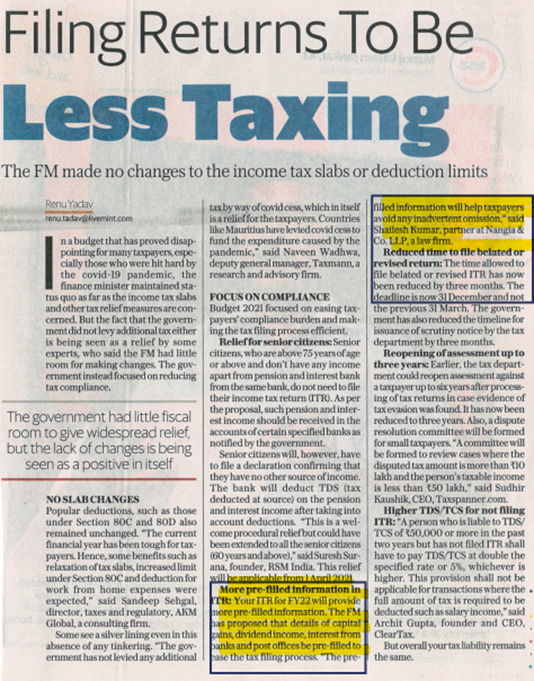

Shailesh Kumar decodes the impact on personal taxation for Livemint

Sunil Gidwani shares insights on NRI residency story for Hindu Business Line.

Sandeep Jhunjhunwala shares insights on the impact on startup sector for Financial Express.

Mr. Nangia shares insights on changes in EPF for Financial Express

Shailesh Kumar decodes the impact on personal taxation for Hindustan Times

Mr Nangia, Aravind Srivatsan and Sunil Gidwani share their take on Budget 2021 for Taxsutra

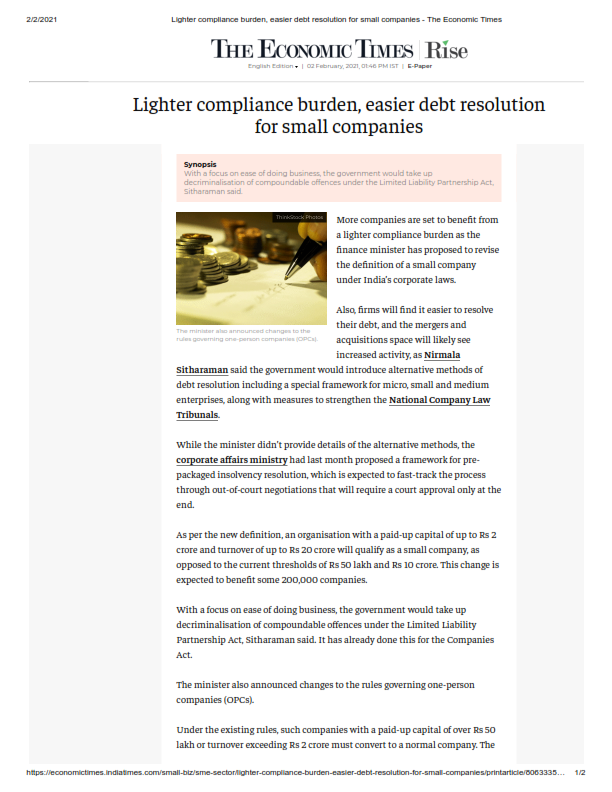

Nischal Arora decodes the changes in regulatory sector for Economic Times.

Neha Malhotra shares insights on the impact in EPF for Hindu Business Line- Front page story

Mr Nangia and Nischal Arora decode the changes in Budget 2021 for Bloomberg Quint

Shailesh Kumar decodes the impact on personal taxation in a piece for Financial Express.

Sudin Gidwani with inputs from Naitik Doshi decode the impact on Financial Sector in a piece for Bloomberg Tax(US)

FPI’S may have to wait for dividend tax relief by Sunil Gidwani.

Mr Nangia and Sudin Sabnis write an piece on Union Budget brings roadmap for Aatmanirbhar Bharat, now eyes on implementation for Financial Express.

Mr. Nangia shares his take on Budget 2021 with International Tax Review(UK)

Expect InvITs in solar space – Aravind Srivatsan

Relief for NRIs facing double taxation for Financial express. – Yogesh Kale, Director

Equalisation levy: Finance Bill clarification to bring more players under the net for Hindu Business Line- Front page/ First story. – Sandeep Jhunjhunwala

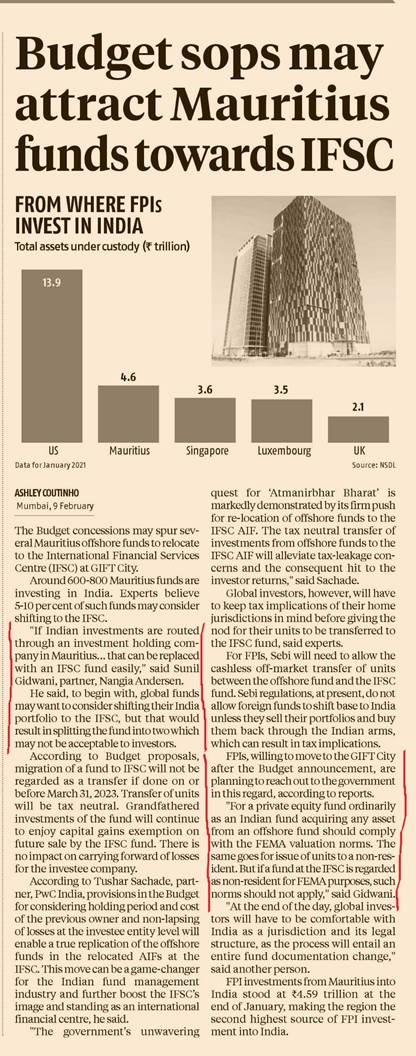

Budget sops may spur up to 10% Mauritius funds to relocate to IFSC – Sunil Gidwani

Exploring Union Budget 2021 – Rakesh Nangia

FPIs want dividend tax issue sorted out in budget . – Sunil Gidwani

Experts Suggest Personal Tax Tweaks For A ‘Never Before’ Like Budget – Shailesh Kumar

Standard deduction hike on agenda – Shailesh Kumar

Income Tax- Salaried class needs new tax sops due to work from home costs – Neha Malhotra

What India Inc. expects from Budget 2020-21- A exclusive conversation with NEWS X – Rakesh Nangia

What are corporates and individuals expecting from Budget 2021 – Zee Business money guru. – Rakesh Nangia

Overall Budget expectations- In conversation with Zee Business. – Rakesh Nangia

Budget 2021: Does the new tax regime need a tweak for a facelift? 4 experts weigh in – Rakesh Nangia

Govt to offer clarity on tax residence rules for fiscal 2021 – Rakesh Nangia

What Modi govt should do to revive pandemic-hit economy – Rakesh Nangia

These tax, legal reforms in Budget 2021 may boost Indian economy as tax revenue seen at record low – Aravind Srivatsan and Neha Malhotra, Director

Capital markets eye Union Budget 2021; TCS, STT rebate, among 6 expectations from Finance Minister – Sunil Gidwani, Partner

Equalisation levy and its fitment into the constitutions – Rahul Mitra, Senior Advisors

India Budget 2021—What Multinationals Are Expecting – Rakesh Nangia & Neha Malhotra

An conversation with NEWSX, decodes the Economic Survey 2020-21 – Rakesh Nangia, Chairman

Budget 2021: Individual taxpayers look for tax relief – Neha Malhotra, Director

NEWSFLASH: India Budget Statement, 2021: Detailed Analysis of the Fine Print

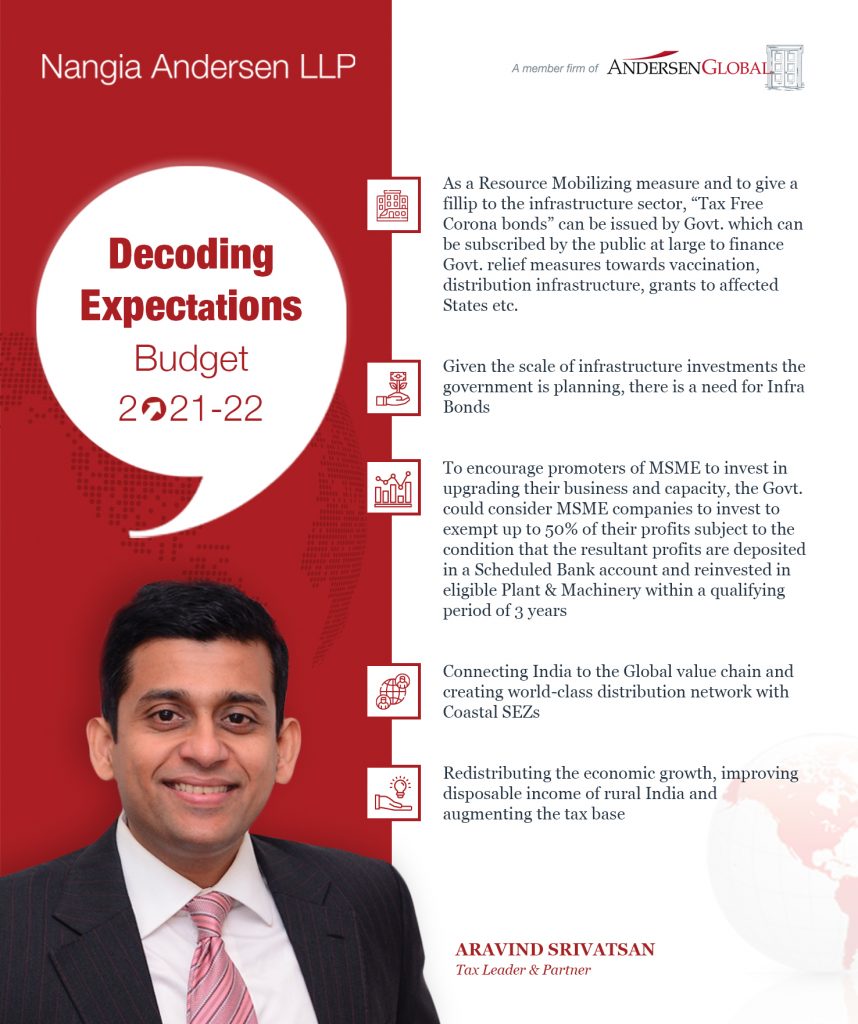

Budget 2021 is just around the corner and there are flurry of expectations from Union Budget 2021-22. According to Our Tax Leader & Partner, Aravind Srivatsan, “Budget 2021 needs to come up with decisive firm measures which take India forward acknowledging the problems through focused solutions to create our aspiration of a more meaningful India for the rest of the world”.

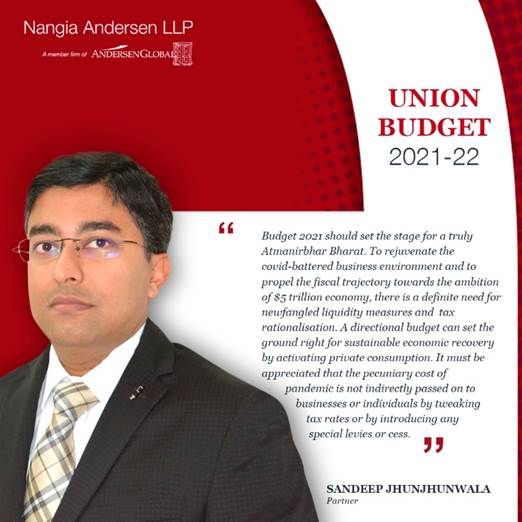

According to our partner, Sandeep Jhunjhunwala: “Budget 2021 should set the stage for a truly Atmanirbhar Bharat. To rejuvenate the covid-battered business environment and to propel the fiscal trajectory towards the ambition of $5 trillion economy, there is a definite need for newfangled liquidity measures and tax rationalisation. A directional budget can set the ground right for sustainable economic recovery by activating private consumption. It must be appreciated that the pecuniary cost of pandemic is not indirectly passed on to businesses or individuals by tweaking tax rates or by introducing any special levies or cess.”

Watch our partner, Sandeep Jhunjhunwala, decoding tech sector expectations from Budget 2021.

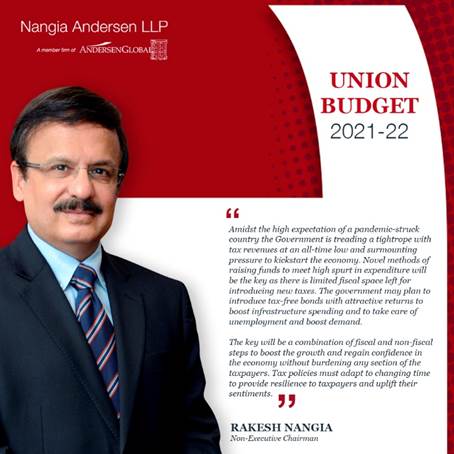

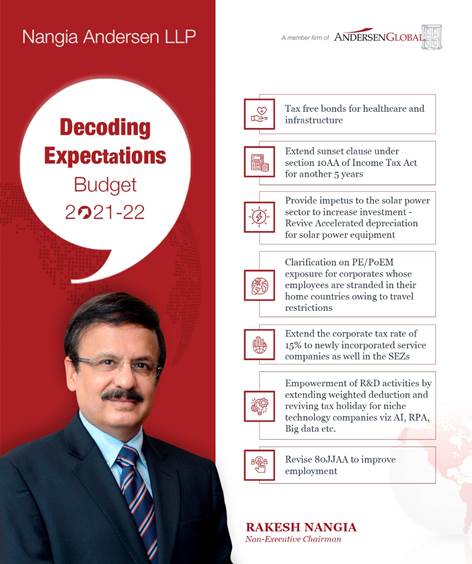

According to our chairman, Rakesh Nangia “Amidst the high expectation of a pandemic-struck country the Government is treading a tightrope with tax revenues at an all-time low and surmounting pressure to kickstart the economy. Novel methods of raising funds to meet high spurt in expenditure will be the key as there is limited fiscal space left for introducing new taxes. The government may plan to introduce tax-free bonds with attractive returns to boost infrastructure spending and to take care of unemployment and boost demand. The key will be a combination of fiscal and non-fiscal steps to boost the growth and regain confidence in the economy without burdening any section of the taxpayers. Tax policies must adapt to changing time to provide resilience to taxpayers and uplift their sentiments.”

Watch our Chairman Rakesh Nangia, sharing expectations from Budget 2021:

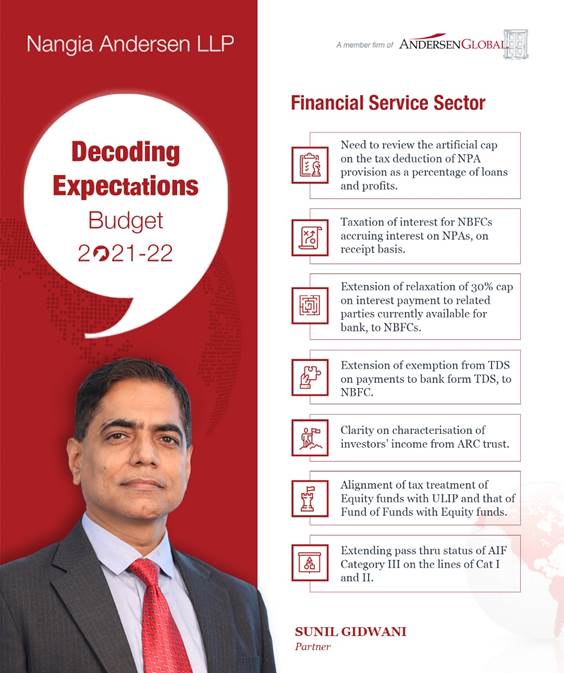

According to Sunil Gidwani, Partner, Nangia Andersen LLP: “Capital markets are considered barometers of economic health and financial institutions backbone of the economy. While current buoyancy in the capital markets reflects confidence in the Indian economy, certain part of financial infrastructure especially the lending institutions and asset managers that have experienced tremendous stress in the recent past need helping hand in terms of regulatory and fiscal support”.

Watch our partner, Sunil Gidwani, decoding Financial service sector expectations from Budget 2021.

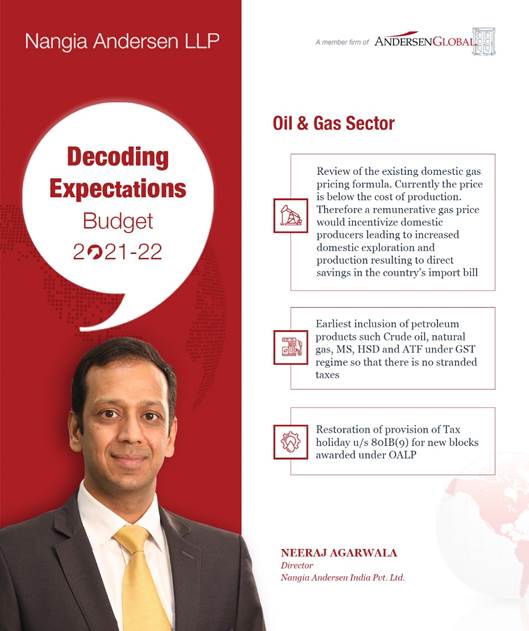

According to Neeraj Agarwala, Director, Nangia Andersen India “This year’s Budget gives us hope for a better tax regulation and steps to boost the domestic industry to revive the economy after a year of turbulence. The key demand from the industry and individuals would include reducing non-corporate income tax rates, incentives to the specific sector including infra and healthcare, abolishing long-term capital gains tax on the sale of equity and further simplification of GST and tax compliances”.

Watch Neeraj Agarwala, decoding Oil & Gas sector expectations:

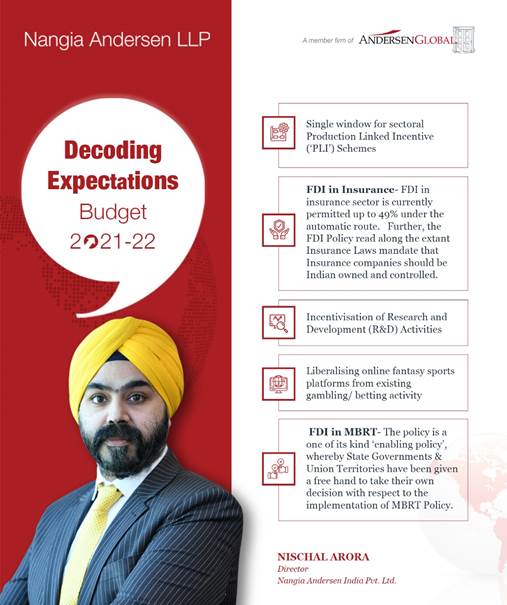

According to him, “As the country looks forward to a V-shaped recovery, it is imperative to stimulate the economy by way of fiscal measures. The Government has identified ‘manufacturing’ as a thrust area to drive growth in the year 2021, a year which has also been identified by the World Economic Forum as ‘The Great Reset’. Introduction of Production Linked Incentives to ‘champion sectors’ is a step in the right direction. However, efforts need to be made to align factors of production viz., Foreign Investment with Indian labor so as to usher in an era of job-led growth in the coming decade.”

Watch our Director, Nischal S Arora- Nangia Andersen India shares regulatory expectations from budget 2021

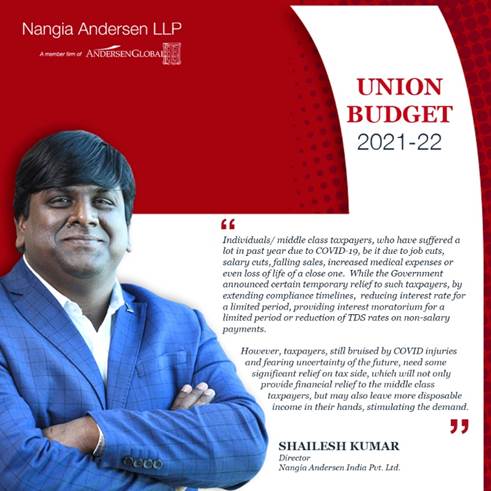

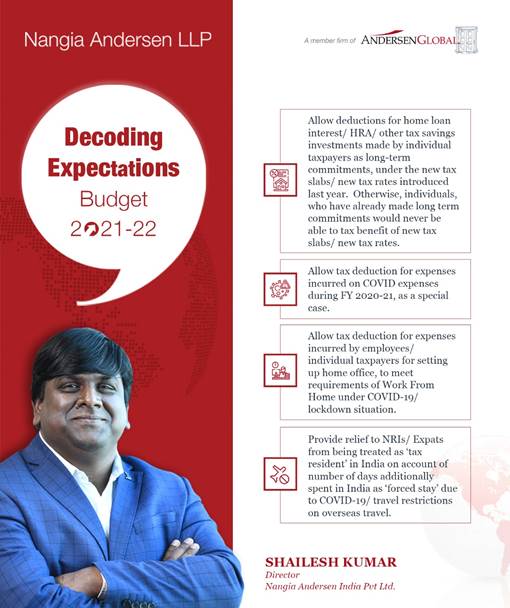

According to Shailesh Kumar, Director, Nangia Andersen India: Individuals/middle-class taxpayers, who have suffered a lot in the past year due to COVID-19, be it due to job cuts, salary cuts, falling sales, increased medical expenses, or even loss of life of a close one. While the Government announced certain temporary relief to such taxpayers, by extending compliance timelines, reducing interest rates for a limited period, providing interest moratorium for a limited period, or reduction of TDS rates on non-salary payments. However, taxpayers, still bruised by COVID injuries and fearing uncertainty of the future, need some significant relief on the tax side, which will not only provide financial relief to the middle-class taxpayers but may also leave more disposable income in their hands, stimulating the demand.

Watch our director, Shailesh Kumar – Nangia Andersen India, sharing common man’s expectations from Budget 2021

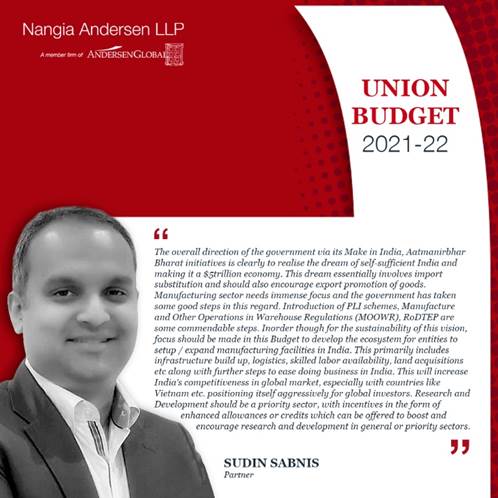

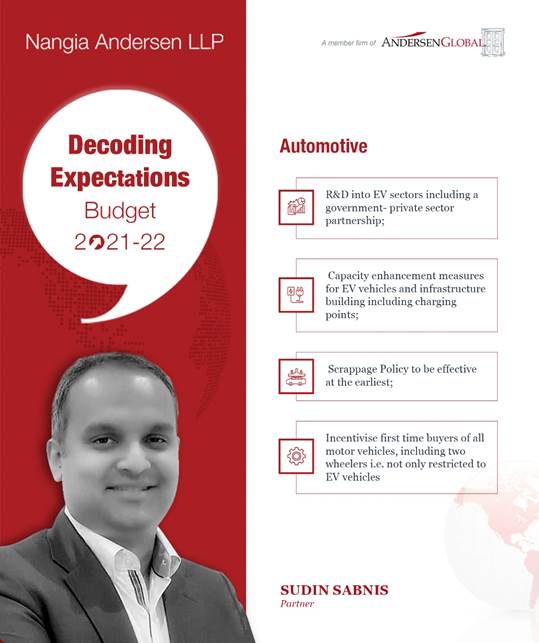

According to Sudin Sabnis, Partner, Nangia Andersen LLP: The overall direction of the government via its Make in India, Aatmanirbhar Bharat initiatives is clearly to realize the dream of self-sufficient India and making it a $5trillion economy. This dream essentially involves import substitution and should also encourage the export promotion of goods. The manufacturing sector needs immense focus and the government has taken some good steps in this regard. Introduction of PLI schemes, Manufacture and Other Operations in Warehouse Regulations (MOOWR), RoDTEP are some commendable steps. In order, though for the sustainability of this vision, the focus should be made in this Budget to develop the ecosystem for entities to setup / expand manufacturing facilities in India. This primarily includes infrastructure build-up, logistics, skilled labor availability, land acquisitions, etc along with further steps to ease doing business in India. This will increase India’s competitiveness in the global market, especially with countries like Vietnam, etc. positioning itself aggressively for global investors. Research and Development should be a priority sector, with incentives in the form of enhanced allowances or credits that can be offered to boost and encourage research and development in general or priority sectors.

Watch our partner, Sudin Sabnis, sharing manufacturing sector expectations from Budget 2021.

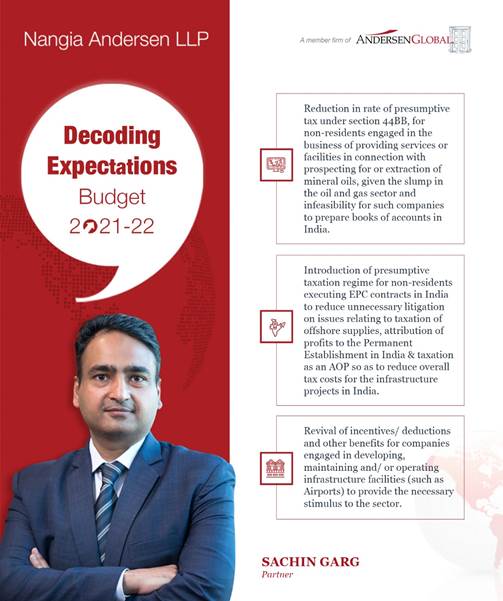

According to Sachin Garg, Partner, Nangia Andersen LLP: Government should aim towards streamlining tax regime for infrastructure/ EPC sector in India, to provide certainty to EPC players on taxation issues and to reduce litigation. Given the Government’s increased focus on infrastructure spending, this would provide much needed impetus to the sector and aid in revival of the economy.

Watch our partner, Sachin Garg, sharing EPC sector expectations from Budget 2021

According to Amit Agarwal, Director, Nangia Andersen India: The honorable Finance Minister has already expressed her intention to push big-ticket reforms in the 2021 union budget. Industry leaders and citizens have high expectations that budget announcements will lift the Indian economy from the pandemic slowdown and accelerate employment. More focus should be emphasized on the Make in India incentive and big credibility should also be given to locals to vocal to strengthen the economy.

Watch our Director, Amit Agarwal- Nangia Andersen India, sharing M&A Tax and Transfer Pricing expectations from Budget 2021.