Introduction

Entrepreneurship has taken centre stage in India and this culture does not stop at well placed employees setting up a start-up, it has also percolated to employees shunning secured jobs in established companies for taking up more exciting and risky opportunities in start-ups.

Multiple people play a role in a start-up’s journey from being a bootstrapped venture to becoming a Unicorn. This value discovery exercise is a result of endeavours of employees and consultants as much as the founders.

Start-ups wherein monetary resource are scarce, resort to equity compensation as a means of reward mechanism which also serves the purpose of aligning everyone’s interest towards growth trajectory of the company. Equity compensations go a long way to showcase that its people would get a share of the pie on the start-ups growth journey during a liquidity event (listing, stake sale, etc). Further, equity compensation also proves helpful for start-ups as the same help preserve cash and manage the tax outlay for such personnel. The right mix of in-hand salary coupled with equity compensation is used by start-ups to attract, motivate, and retain the required resource pool over a longer period of time

Our Professionals

Vishwas Panjiar

Partner

Chirag Nangia

Director

Equity compensation can be facilitated in various forms,

- Employee Stock Options (ESOPs),

- Employee Stock Purchase Plan(ESPP),

- Stock Appreciation Rights(SAR),

- Restricted Stock Unit(RSU),

- Sweaty equity

- Management Stock Option Plans(MSOPs).

Generically an equity settled plan can be referred as an ESOP which entails creation of ESOP Policy, implementation thereof after obtaining the requisite board’s and shareholder’s approval, granting the options(by issuing grant letters), vesting for eligibility to acquire underlying shares, actual exercise of the option and resultant allotment of shares. Upon allotment of shares, the holders might choose to hold on to the shares for further upside or transfer for monetisation

Journey of ESOPS

Structuring an ESOP

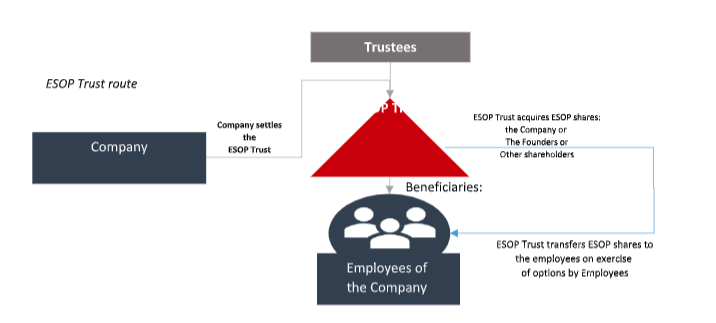

ESOP modality involve taking various decisions with respect to the overall scheme including, inter-alia, trust routes, vis-à-vis, direct route, fresh issue or ESOP pool, pool size, intended coverage of the scheme, discount factor, valuations. Each such aspect entails various considerations (people decisions as well as tax and legal structuring decisions come into play) which need to be borne in mind.

Each route may have its own sets of challenges and implications which needs to be factored in while structuring the plan. For instance, the Trust route might be preferred for creating a pool of shares for employees but the same might entail undue challenges and procedural compliances towards dealing with the stock at liquidity event, setting up trust, holding PAN, tax implications, funding, et al . Under the simpliciter direct route, the company grants the option to the employees and fresh equity gets issued to the employees upon exercise.

Select regulatory framework

It would also be pertinent to highlight that the benefit in through ESOP can only be extended to eligible employees which have been spelt out in Rules to Companies Act, 2013 and the same specifically exclude the promoters (founders) and directors, holding more than 10% of the capital of the Company.

A specific relaxation from the above limitation has been afforded only to eligible start-ups(being Start-up Company recognized by the Department for Promotion of Industry and Internal Trade (DPIIT)) which are exempted from participation restrictions for a 10 year period from their incorporation or registration with the DPIIT.

The aforesaid relaxation brings respite only for eligible start-ups which are very small sample out of the overall start-up space: 565,076 (Startup India Hub) out of which only 71,304 start-ups have been granted DPIIT recognition till date. The Income-tax Act, 1961 also subsumes some relaxations for the eligible start-ups, however, the income-tax recognitions have been so parsimonious (mere 448 start-ups1 have been recognised) that it’s futile to discuss the income- tax relaxations for start-ups.

The taxability event in case of ESOP, is the actual exercise date and not the grant date. To reiterate, the actual taxability arises to the employee on the benefit derived in the form of getting the share of the company at a discounted price , upon issuance of shares pursuant to exercise of the option.

Monetising ESOP

Such benefit can only be derived by the employees through monetisation of the shares allotted to them through the ESOP. However, in the case of start-ups, the underlying shares are often illiquid and thus taxing the employees in such a scenario can lead to undue hardship in the form of an unfunded tax liability (that too at the normal applicable slab rates). For liquidity creation in such cases, the ESOP shares are often simultaneously bought out by the Promoters at a pre-determined price depending on the stage of the company

The missing link

The Indian start-up community has been expecting various further relaxation from the legislators including wider coverage of amendments in Finance Act, 2020(incorporate all the DPIIT-recognised start-ups), include start-ups that were once DPIIT-recognised but now have annual revenue of over INR 100 Cr and ESOP taxability only on transfer of ESOP shares.

On the start-up front, the claim of expense towards the ESOP has been a matter of debate by virtue of the divert views in various judicial pronouncements by various forums. The dichotomy is based on the premise that the ESOP entails issuance of shares leading to change in the share capital and thus is a capital nature item which would not be allowable as a business expense. Other more popular school of thought which has received the High Court’s blessing avers that the primary objective of issuing shares to the employees at a discount is to compensate employees for their continued service and the expense related to ESOPs is allowable as a deduction.

From the start-up perspective, it is imperative to account for the ESOP cost in the financials and also claim the same whilst filing their tax returns. Thus, valuation of the options needs to be carried out from an accounting perspective at the very grant of the options to the Employees. Such valuation helps in determination of the ESOP expense which is recognised on straight-line basis over the vesting period of the underlying options. The valuation of such stock options after taking into cognizance various underlying factors is to be carried out based on intrinsic value method or Fair Value Method(done based on option pricing methods such as Black Scholes Merton or a Binomial Model). From an income tax perspective, since the differential between the exercise price recovered from the employees

and the FMV of the shares is taxable as perquisite for the employees, the FMV determination of the shares needs to be carried out. Such FMV shall be the value as determined by Category 1 Merchant Banker (registered with SEBI) either on the exercise date or any earlier date not older than 180 days prior to the exercise date.

Further, the present corporate laws put in place several limitations with respect to ESOPs including minimum vesting period of 1 year. The Company law Rules also place an embargo on the Employees with respect to the options granted to them: they are not permitted to transfer, pledge, hypothecate, mortgage or otherwise encumber any employee stock options granted to them. Thus, only the employees to whom the options have been granted can exercise such options for issuance of shares.

MSOP

Start-ups often resort to Management Stock Option Pool(MSOP) and other avant-garde structures for facilitating similar offerings to non-employees and efficiently manage the other impediments. Start-ups have also started resorting to externalisation of their holding structures wherein the ESOPs are sought to be granted by the overseas holding company which helps crease out a lot of issues in the overall ESOP plan and also helps navigate the implications on the tax front for the employees.

Start-ups have an important role to play in the today’s innovative space and equity compensation is one of the strategic tools for such start-ups to align the best resource pool whilst managing liquidity and tax efficiency. The whole equity compensation planning and roll-out process would need to be thought through to ensure its smooth implementation and the desired results.

Concluding thoughts

The recent years have witnessed the come-back of classic ESOP, which ensures that employees also have skin in the game and are invested in the success of a start-up. Pureplay cash compensation is no longer lucrative for young talent in the fast-growing start-up ecosystem. This is very much evident from new-fangled ESOP variants being rolled out by start-ups, viz. TSOPs (Unacademy launched ESOPs for teachers on its platform), PSOPs (Urban Company launched a partner stock option plan for its service partners) and MSOPs (BharatPe offered shares to merchants).

Resorting to equity compensation by Indian start-ups has played an instrumental role in spreading awareness and have also proved to be a means for corporates to showcase their commitment to sharing their success stories with the people who have played role in the same.

Download

Equity Compensation by Start-ups!

Size: 1 MB